Our Beginner’s Guide to Mental Health Billing is for the brand new and having-no-clue outpatient therapist looking to learn how to bill insurance companies. You will learn what client information you need, how to verify mental health benefits, create and submit claims, and account for EOBs.

Every mental health insurance claim will require a large amount of information, but that information needn’t be overly complicated.

Our guide to mental health billing will first discuss your client information, then the most frequently used mental health CPT codes, how to verify eligibility and benefits for behavioral health services, and finally how to submit claims.

If you know you want to work with our team of billing experts to get your problems sorted right now, simply drop us a line.

Each of those steps aren’t exactly one step but with this comprehensive structure of how to bill mental health insurance, let’s begin!

Required Demographic Information:

Required Insurance Information:

That being said, we recommend snapping a front and back photo of their insurance card for your records.

Having the customer service phone number isn’t essential for submitting claims, but is necessary to gather eligibility and benefits information and to verify claim status and payment amounts.

Time to move onto mental health CPT codes.

It’s as straight forward as it seems: bill the intake code for their first session, and bill either a 45 minute or 60 minute session for the rest, depending on the length of their sessions.

Dealing with family therapy, therapy with a family member with the patient not present, group therapy, or other cases? Review our definitive guide to CPT codes to get sorted!

If you are struggling to translate specific aspects of your services to ICD10 diagnosis codes and CPT codes, we are experts at helping specifically and exclusively with our mental health billing and coding service, so consider reaching out.

With telehealth becoming a popular if not required option for conducting therapy sessions in 2020, keep note of the following four points when billing telemedical therapy appointments:

If you are struggling to find out the place of service code or modifier to use for your insurance claims, this is something we provide as part of our billing service free of charge.

Our beginners guide to mental health billing doesn’t make eligibility and benefits verification calls for you, but we do!

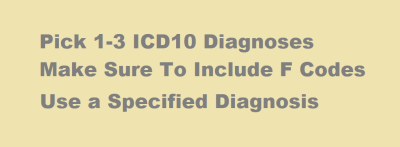

We cannot and will not advice you to use a single diagnosis code, even though it is a very common practice for therapists to use one code for all of their patients (e.g. anxiety or depression).

It is your duty, as demanded by submitting any insurance claim, to submit the most accurate diagnosis you possibly can for each session. If their diagnosis changes, you need to update it on your claims forms.

Tip: Always use a specified diagnosis. Since the ICD10 / DSM-5 change, unspecified diagnoses are being rejected by Medicare. (Source)

Otherwise, just review our ICD10 Mental Health Diagnosis Code Search Tool to pick the most accurate diagnosis.

Okay! You have all the necessary patient and session information to file claims. Now it’s time to check eligibility and benefits to ensure they have coverage that will reimburse you.

We have a guide called “How to Check Mental Health Eligibility and Benefits” at this link which contains a script and thorough questions to ask so you gather all necessary information.

If you want the quick and dirty version, you’ll need to:

Okay! You now have all the necessary information to file claims, you know what to charge the patient in person, and you know where to file the claims.

Unfortunately, this is the extremely annoying, hard part. There is no “quick guide” way of handling this process.

The cheapest option is to learn how to use “PracticeMate” by OfficeAlly to submit claims, even though it is made for hospitals.

You can try to use a purely software solution to input the data and create the forms. You can reach out to us for help: we do every part of the billing process for you. (Not free but you may live longer without that stress).

However you end up doing them, you need to transcribe this information onto a CMS1500 form and send it electronically or physically to the insurance company.

Once you’ve done that..

If you’ve mailed in claims, wait 4 weeks to call and verify claims are received. If they haven’t been received, verify their claims address and submit again.

It’s critical to submit them within the 90 day timely filing window most insurance companies hold you to (not all, but most).

Once claims are verified as received, it’s time to hurry up and wait until payment. Often processing takes two to three weeks after receipt of the claims, plus the time to mail checks.

You will received EOBs in the mail along with a check for those dates of service.

Finally, add them to your appointment list spreadsheet or tracker, including

Each denial or rejection can happen at one of two places, either at the Clearinghouse level or the insurance company level.

Use your EHR portal to determine if the claim has been denied at the clearinghouse for a missing enrollment, bad subscriber ID, or incorrectly submitted information. (We help with this).

You can ensure your claim is not denied at the clearinghouse by calling the insurance company and asking if they have the claim on file. If they do, the claim made its way through your clearinghouse. If not, you need to resolve the problem at the clearinghouse level.

If the claim is on file with insurance and is denied, you need to understand the denial reason. Is it for timely filing, terminated coverage, a coordination of benefits issue, unauthorized sessions, needing updated provider information, to just name a few denial reasons?

Go claim by claim, date of service by date of service, and refile the claims as correct with insurance.

If your claims require appeal, speak to a customer support representative about obtaining the necessary forms to file your appeal. Use your reference ID from your eligibility and benefits verification phone call to fight your case.

Fighting denials and rejections is the hardest part of billing. This is yet one more reason why mental health providers choose billing services like TheraThink to help. This is a headache you don’t deserve nor are your trained to handle. Consider outsourcing this work to experts.

It’s a damn shame that submitting insurance claims is such a pain.

We wish it were easier, as the whole process causes revenue loss, frustration, and inefficiency in our health care system.

That being said, if you just want to gather up your new patient’s demographic info and their subscriber ID, we can take care of the rest.

Hopefully this guide was a helpful introduction to mental health billing claims.

Please let us know in the comments how we can improve it, answer your questions, and simplify the process.

Let us handle handle your insurance billing so you can focus on your practice.

Get Billing Help

Note: We only work with licensed mental health providers.